Reporting of Foreign Bitcoin Holdings

You may have heard about FBAR or FinCEN reporting of foreign bank accounts and foreign assets. These items are not new and in fact the IRS has been increasing enforcement of reporting foreign accounts lately. It has been a standard question on Schedule B of your 1040 for many years.

The IRS has been vague regarding the reporting of Bitcoin and other cryptocurrencies on the FBAR (Report of Foreign Bank and Financial Accounts). But considering what we know about FBAR reporting and the IRS' view of Bitcoin, it is better off acting conservatively and reporting it when it is presumably intended to be reported. That sounds complicated, so let's break it down into a simpler way of looking at it.

The IRS views Bitcoin and cryptocurrencies as property, not a currency as the name may seem to imply. This is essentially the same treatment as stock investments in a brokerage account. That is exactly how you should view Bitcoin when looking at the FBAR reporting requirements. Instead of Bitcoin, think shares of stock. Instead of a cryptocurrency exchange, think brokerage account. In this light, it seems farily clear that Bitcoin held in foreign accounts should be reported on the FBAR and Form 8938 (Statement of Specified Foreign Financial Assets).

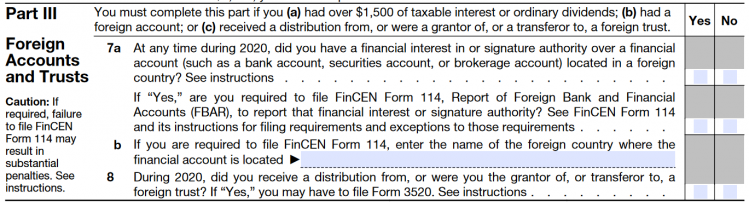

As you can see above, the first question regarding Foreign Accounts and Trusts is, "At any time, did you have a financial interest in or signature authority over a financial account (such as a bank account, securities account, or brokerage account) located in a foreign country?"

I have bolded the key parts:

- Financial Interest: This is easy, are you invested in Bitcoin? Does it have monetary value to you? If the answer is yes, then you have a financial interest.

- Brokerage Account: As mentioned above, use cryptocurrency exchange and brokerage account interchangebly. If you keep your Bitcoin or other cryptocurrency in an exchange. This applies to you.

- Foreign Country: Since we are talking about Foreign Accounts, it makes sense that you only need to report it if the exchange is in a foreign country. You need to understand where the Cryptocurrency Exchange is located to know if this applies to you. The biggest one in the United States is Coinbase, and as a US based company if you only keep Bitcoin on Coinbase, this would not apply since it is not a foreign country. The largest US based exchanges are Coinbase, Gemini, Kraken and Poloniex. Most other exchanges are foreign so if you use any of those, this most liekly applies to you.

What about cold storage or hardware wallets? If you keep your Bitcoin and other cryptocurrency in a hardware wallet, paper wallet, or other form of cold storage, it is most likely not subject to Foreign tax reporting. If you control the wallet and control the private keys, it would be considered located where you are located.

Now that you understand if Foreign Account reporting potentially applies to you the last step, is to determine if you actually need to report it. If your holdings of Bitcoin in a foreign account exceed the reporting threshold, then you must report it. Generally, as of 2020, FBAR reporting is required if the value of your account exceeded $10,000 at any point during the year (yes that includes if it was only for 1 single day). Form 8938 reporting is determined based on single/married filing status but if your holdings are greater than $50,000 (single)/$100,000(married) at December 31 or greater than $75,000/$150,000 at any point in the year, Form 8938 reporting is required.

Consult a tax advisor regarding your specific reporting requirements.