Bitcoin and Other Cryptocurrency Taxes in the United States

Are my Bitcoin and Other Cryptocurrency transactions taxed in the United States?

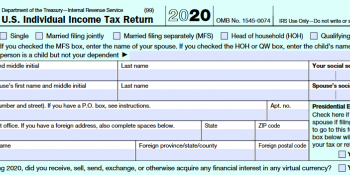

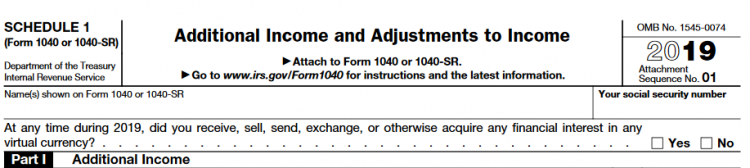

They certainly are. In fact starting in 2019, when you file your 1040 with the IRS, you are expressly asked whether or not you had any transactions in virtual currencies. Most tax professionals feel that this is going to allow the IRS to aggressively come after people in the future if the IRS determines it was intentionaly omitted.

How are Bitcoin and Other Cryptocurrency transactions taxed?

Bitcoin and other virtual currencies are taxed like property as defined in IRS Notice 2014-21. But the exact treatment depends on the transactions that took place. Let's take a look at how certain transactions are treated:

- I bought Bitcoin with U.S. Dollars, is that taxable? No, simply buying cryptocurrency with cash is not taxable, but it is very important to keep track of how much you spent and when you spent it, this will be important later.

- I bought Ethereum with Bitcoin, is this taxable? Yes, selling one cryptocurrency for another is a taxable event. The difference in your basis in your cryptocurrency and the value of the new cryptocurrency at the transaction date is a capital gain or loss. For example, if I buy 0.001 Bitcoin for $100 on 3/1/XX then on 5/1/XX I buy 0.5 ETH for 0.001 BTC. This is taxable. To calculate the tax, you determine how much 0.001 BTC is on 5/1/XX, in this case it is worth $120. You would report and pay tax on a short term capital gain of $20 on your tax return. Your basis in the 0.5 ETH is $120 for any future transaction.

- I transferred Bitcoin from one wallet to another, do I have to pay tax on that? No, if you control both wallets, there is no taxable event.

- You received Bitcoin for performing a service or selling a product? In these situations, the value of the Bitcoin received is considered ordinary income and would be subject to self-emplyment taxes, if applicable. The value of the income is the value of the bitcoin that you received.

- I was able to mine Bitcoin, is that taxable? Yes, the value of the Bitcoin that you mined is taxable as ordinary income on the date that you received it.

- My crytptocurrency hard-forked and I received another cryptocurrency as a result, free money? No, that is taxable. The value of the new cryptocurrency is considered ordinary income on the date that you received and can control it. The fair market value of the currency is the amount of income to be recognized.

Before you said buying Ethereum with Bitcoin is taxable, what about 1031 exchanges to defer the tax?

There was some confusion as to whether or not cryptocurrency exchnages prior to 2018 were eligible for 1031 exchanges. What is clear is with the new tax law introduced in 2018, virtual currency is not eligible for 1031 exchanges. Suzanne Sinno, an attorney in the IRS Office of the Associate Chief Counsel, said it is the agency’s position that like-kind exchange principles were never applicable to cryptocurrency.

I thought Bitcoin and other transactions were anonymous? How will the IRS find out?

Wrong, Bitcoin may seem anonymous, but it is not. In fact the IRS is going after exchanges to get this information. It issued Coinbase a John Doe summons to get records of all of its transactions. While it failed to get complete records, on November 28, 2017, the Federal District Court for the Northern District of California entered an order requiring Coinbase to provide the IRS with data on its clients who engaged in transactions exceeding $20,000. Coinbase included tax reporting of capital gains and losses in this information.

Where can I find more information?

The IRS has put together a Frequently Asked Questions article regarding the taxation of cryptocurrencies.