During 2019, the IRS added a question on the top of Schedule 1 asking, "At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?" Not every filer is required to file Schedule 1, therefore not everyone had to answer this question.

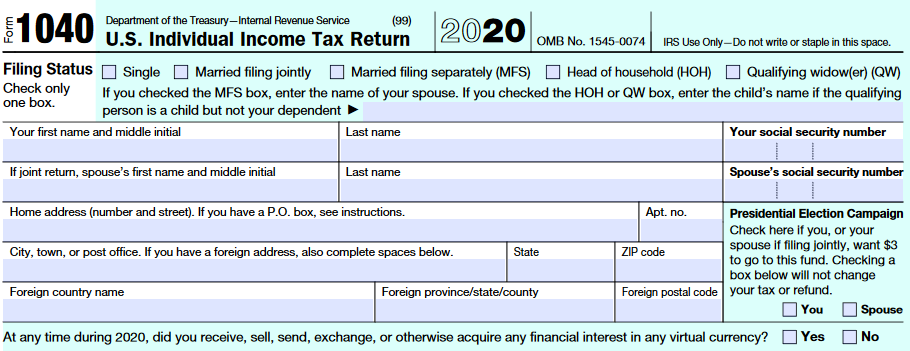

For 2020, the IRS has moved this question to the top of the first page of the 1040. It is literally the first question on the form after your name and address. For 2020, every single person who files a tax return must answer this question under the penalty of perjury. The IRS is going to be able to gather data to attempt to go after tax evaders in the future.

Just owning Bitcoing doesn't mean it is taxable, this site will help you understand if your Bitcoin and other cryptocurrency holdings are considered taxable by the IRS.