Determining Your Gain or Loss on the Sale of Bitcoin and Other Cryptocurrencies

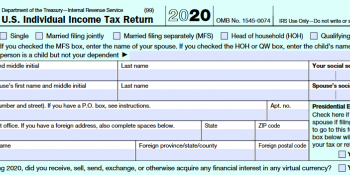

With Bitcoin's continuing rise in value, you might be thinking about locking in some of your gains by selling some of your holdings. As discussed, if you're in the United States, the sale is going to be taxable.

Determining your gain/loss on the sale is not the most difficult thing to calculate once you understand how the process works.

The first and arguable most important step in determining your gain/loss on a sale of Bitcoin or other cryptocurrencies is to know your cost basis.

Once you know how much your bitcoin cost you, the gain/loss is simply the sale price minus the cost basis. It really is that simple... if you purchased all your bitcoin at the same time and sold all of it at the same time.

Most people buy bitcoin and other cryptocurrencies at various points over time and when they sell, only sell a portion of their holdings. If this situation applies to you, then you need to understand the two methods of calculating gains and losses that the IRS allows for cryptocurrency.

- First in First out (FIFO): This method is exactly as it sounds, the first bitcoin purchase you made is considered the first bitcoin you sell. For example, if you buy 1 BTC at $5,000 on March 1, then buy 1 BTC at $10,000 on August 1, when you sell 1 BTC on December 1 for $20,000. Under FIFO, the gain is calculated as if you sold the March 1 purchase before the August 1 purchase. Your taxable gain would be $15,000 ($20,000 sell price less $5,000 purchase).

- Specific Identification: This method is allowed only if you maintain detailed records that allow you to actually identify specific purchases as unique. Using the example above, if you purchased 1 BTC on March 1 and 1 BTC on August 1, when you sell 1 BTC on December 1, you can specifically identify the August 1 purchase as the BTC that you sold, which will reduce your taxable gain to $10,000 ($20,000 sell price less $10,000 purchase). Again to emphasis, you must be able to document all your purchases in order to use specific identification.

What about Last in First Out (LIFO) or average cost? These methods are not allowed. You can not use LIFO, but as mentioned above, if you keep detailed records to use the specific identification method, you may identify your last purchase as your first sale. However, if you cannot show all your specific records of purchases, you cannot blindly identify your last purchases as your first sales. Average cost method is not allowed since you cannot average short term holdings with long term holdings since the tax rates are different.

What will my tax rate be? The tax rate depends on several factors that are unique to you. The first is your holding period. If you bought and sold Bitcoin or other cryptocurrencies within a 12 month period, it is considered a short term gain. The IRS taxes short term gains at your ordinary income tax rate (aka what tax bracket you are in (ranges from 10% to 37%). If you held the asset for more than one-year, you qualify for capital gains tax rates which are generally lower (ranges from 0% to 20%). Your tax bracket is determined by looking at all your income from all sources during the year. Please consult a tax advisor for specific questions regarding your exact situation.